We place immense value on strong relationships by being transparent and protecting customers’ interests which have helped us gain the most important thing, Trust.

Life Insurance

General Insurance

Health Insurance

Term Insurance

Travel Insurance

Motor Insurance

Kindly fill out the form with your name, email, and contact number. Alternatively, you can contact our claim experts by calling us at 95136-31312.

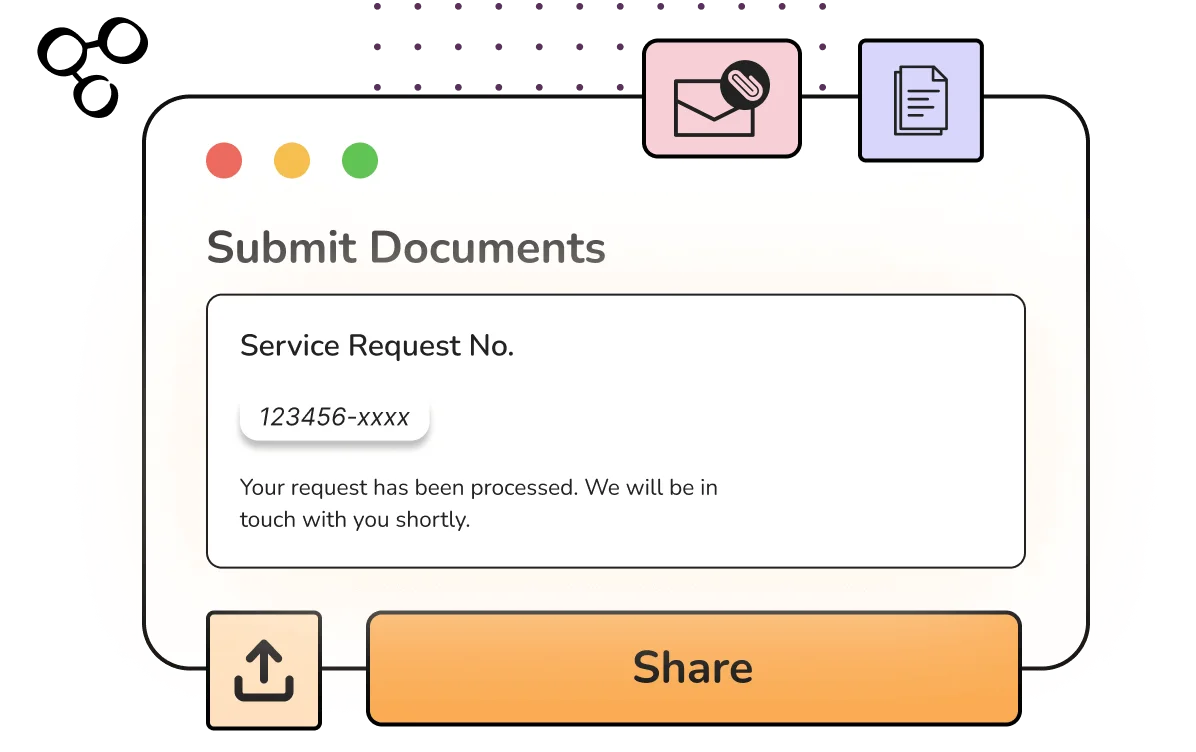

We hear you out and ask you to share copies of case related documents with us.

We will proceed with your insurance complaint after thoroughly reviewing your case particulars and insurance paperwork.

We do not charge anything upfront other than a one-time registration fee of ₹999 only after case acceptance.

Upon successful resolution of your insurance complaint, we charge a success fee of 18% + GST.

Kindly fill out the form with your name, email, and contact number. Alternatively, you can contact our claim experts by calling us at 95136-31312.

We hear you out and ask you to share copies of case related documents with us.

We will proceed with your insurance complaint after thoroughly reviewing your case particulars and insurance paperwork.

We do not charge anything upfront other than a one-time registration fee of ₹999 only after case acceptance.

Upon successful resolution of your insurance complaint, we charge a success fee of 18% + GST.

Insurance Samadhan has a highly efficient team of experienced insurance consultants who can always assist you. Our team is equipped to address any kind of issue you may encounter with your insurance policy.

We understand that customer satisfaction is paramount and we are committed to providing a hassle-free experience for all our clients. That's why we do not charge any success fee until the case is resolved.

We recognise the importance of our customers and are committed to providing them with the highest level of service. Our goal is to create a positive impact in the lives of our customers by delivering exceptional value through our services.

Let's connect! Reach out to us today and get your claim amount.

Aniket

2 weeks agoInsurance Samadhan made my denied car accident claim hassle-free with their smooth process and guidance. Highly recommend them for anyone facing insurance issues!

Mohit Goswami

3 weeks agoAfter my bike accident, Insurance Samadhan guided me with care and expertise, turning my rejected claim into approval. Their support felt like family during a tough time!

Praveen

3 weeks agoI thought my lapsed policy was a lost cause, but Insurance Samadhan made the impossible doable with clear guidance and no hidden fees. Truly a stress-free and fair experience!